» This chapter applies to the Czech Republic.« |

Dotypos allows you to issue an order by so-called proxy. If you want a specific order to be recorded with the Financial Authority with a different Tax Identification Number (VAT) than the one set in the cash register as the default, you can do so with the option SELL BY PROXY in the Payment dialog. However you have to add the new subject to the cash register first. Sell by proxy cannot be used for commission sales.

Dotypos supports sale by proxy even for VAT non-payers. To correctly set product VAT for sale by proxy according to whether VAT is paid or not, have a look at the end of the chapter.

|

You can manage subjects directly in the cash register (see the process below) or via the web interface of Dotypos Cloud. Here, you can also permanently set” sale by proxy for the specific product or the whole category. So products from the relevant category will be always payment by the proxy. |

|

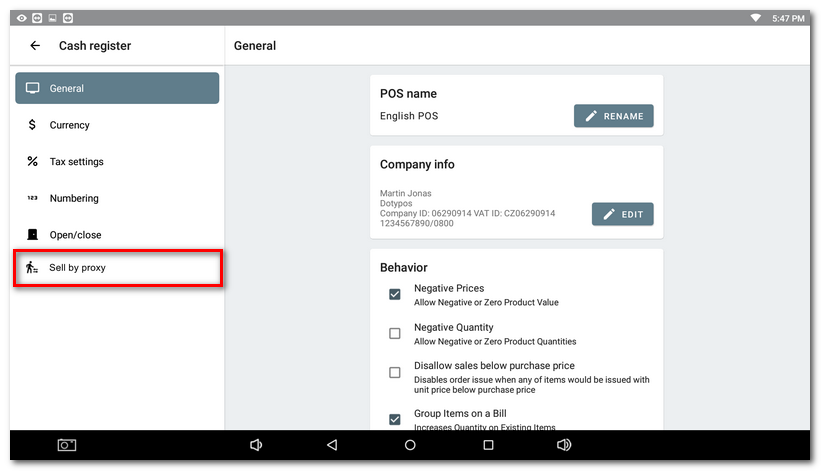

You can manage subjects for sale by proxy in the Application Settings in the Cash register section using the Sell by proxy option. To add a new subject click on this option. |

|

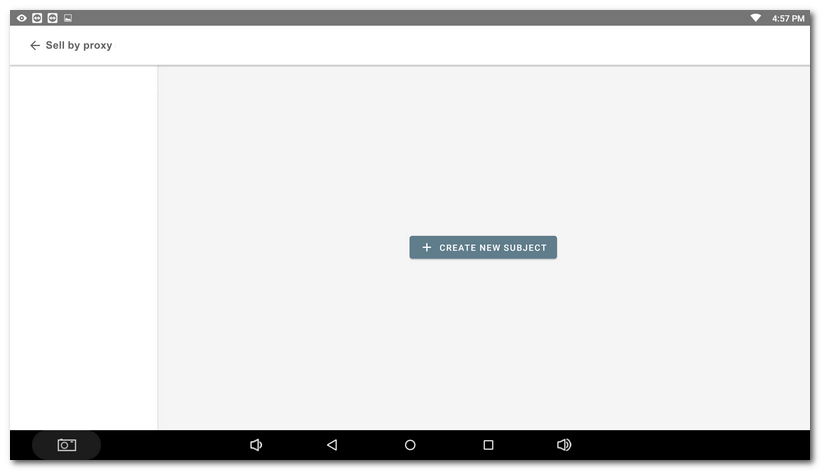

Add new subjects by clicking on the button + CREATE NEW SUBJECT. |

|

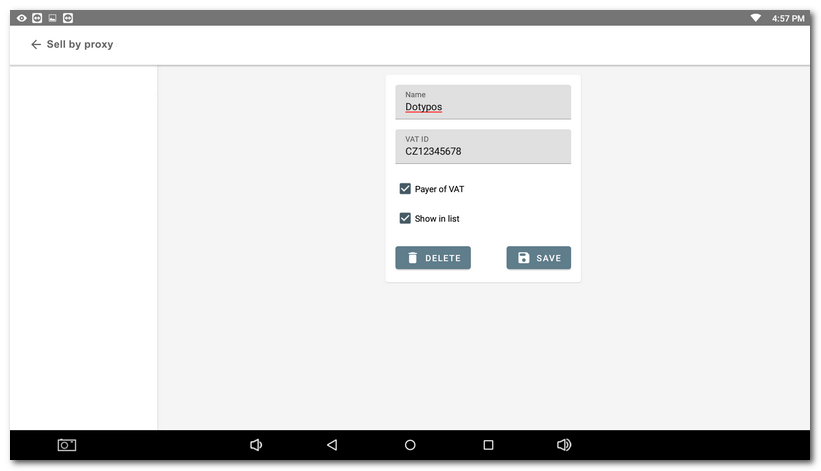

Fill out Name, VAT ID, check off whether the subject is a VAT payer and save everything with the button. Deactivating the option Show in list will temporarily hide the subject and it will not be possible to use it when selling at the cash register. |

|

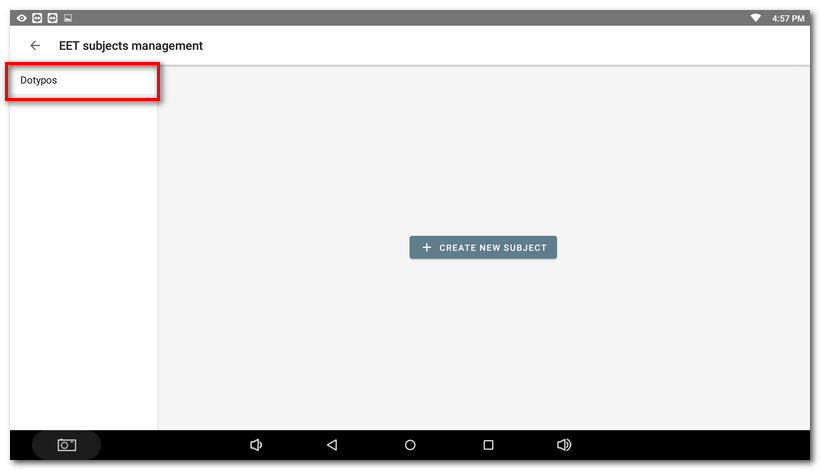

Now the subject has been created and you can use sale by proxy. You can edit an already created subject by tapping on it in the left pane. |

How do I correctly set the product VAT according to whether VAT is being paid for sales by proxy or not?

The “authorized” party is the customer (cash register operator) recording the sale for the “authorizing” party. The authorized party uses its Tax identification number (VAT) as the taxpayer's VAT in the data message. The VAT of the authorizing party is entered as the authorizing taxpayer's VAT. The authorized party enters the establishment where the sale took place and uses its certificate as its signature. This means the authorized party should be the cash register operator and the authorizing party is the subject created in Dotypos. Depending on whether the authorized party and the authorizing party are VAT payers or non-payers, set the correct VAT rate for the relevant products in the cash register. This is displayed in the following table:

Setting VAT rate for products |

||

|---|---|---|

Authorized |

Authorizing |

Related settings in Dotypos |

VAT payer |

VAT payer |

Sale items state VAT by default. |

VAT non-payer |

VAT non-payer |

The customer is marked as a VAT payer and all items are with 0% VAT rate. |

VAT payer |

VAT non-payer |

Items sold by proxy have zero VAT rate. |

VAT non-payer |

VAT payer |

This option is not supported in Dotypos! |

|

One order can only be drawn to one subject (Company ID) with one certificate. So Dotypos does not support the so-called “direct proxy.” |