You set the VAT rates that can be applied to products and categories on this page. Here you have the option to create or delete VAT rates and also change them for selected products. This is appropriate when, due to changes in the legislation, it is necessary to "reclassify" certain sold goods (products) to a different VAT rate. You can specify here whether you wish to keep the current sales price including VAT even after the rate change, or recalculate the sales price of individual products depending on the new VAT rate.

How to add or remove VAT rates?

How to change VAT on selected products in bulk?

Change VAT on products by exporting and importing data

|

Creation / deletion of tax rates, bulk VAT change for selected products can also be done at the cash register in the tax rate editor. |

How to add or remove VAT rates?

|

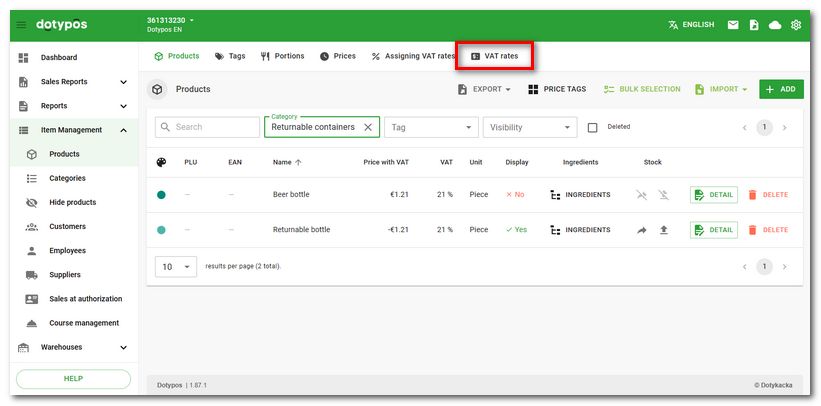

In Dotypos Cloud go to the Item Management » Products tab. In the header, click VAT rates. It is possible that new VAT rates valid from a certain date will already be created after the Dotypos update. Then it is enough to assign them to specific products. |

|

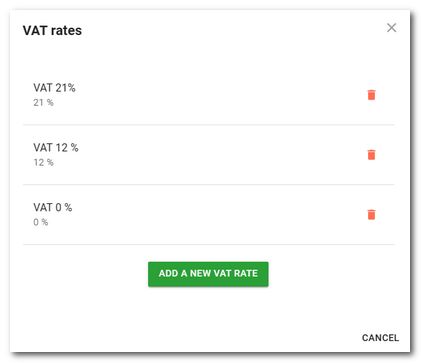

The dialog with the currently created VAT rates in the Dotypos will be displayed. Here, use the ADD A NEW VAT RATE button to add a new VAT rate in percentage. Tap the trash can icon to delete the rate. |

How to change VAT on selected products in bulk?

|

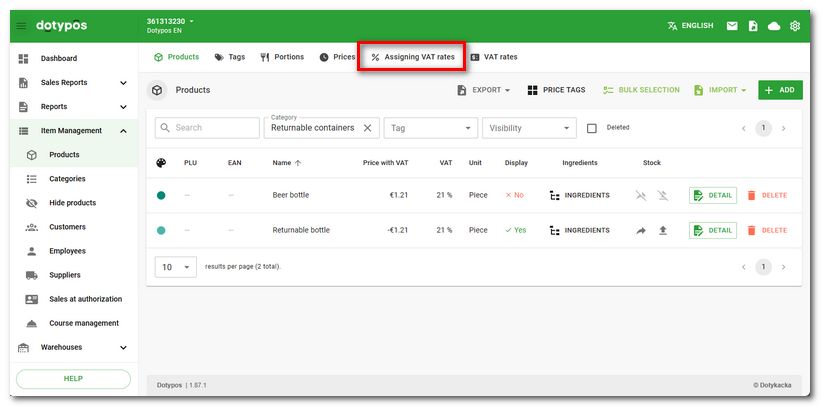

In Dotypos Cloud go to the Item Management » Products tab. In the header, click Assigning VAT rates. |

|

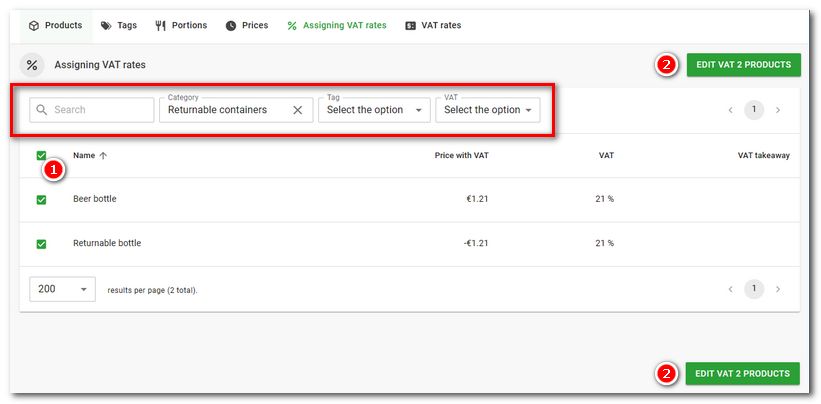

A list of all products will open, which can be filtered based on the selected parameters in the header. Among other things, you can select all products here based on their current i.e. old rate. Check the box |

|

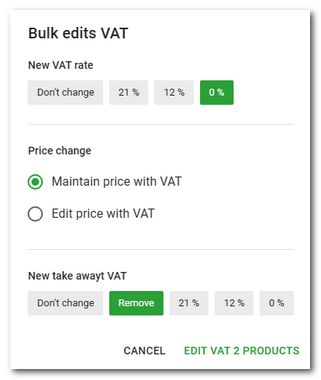

In the following dialog, select the new VAT rate, whether you wish to recalculate the selling price and, if applicable, remove the takeaway rate. Finally, click on the EDIT VAT X PRODUCTS option to overwrite the VAT changes to the marked products. |

Change VAT on products by exporting and importing data

You can also change the assigned VAT rate for products by exporting the products to a file, editing the file and importing it back into the cash register. However, this option is only for advanced users. This modification does not recalculate the selling prices of the products, it only changes their VAT rate.

1.Export the products to an excel file.

2.Make a copy of the exported file and edit it. In the event of an incorrect import, you will have a backup of the original data.

3.Open the exported file and edit the data in the vat column for each product, entering 12 for the 12% rate, 21 for the 21% rate and 0 for the 0% rate.

4.Save the file and import it back into the cash register.

|

After importing an incorrectly edited file, the properties of individual products may be changed! Therefore, be cautious and check the modified file before importing it into the cash register. After importing, we recommend checking the products directly in the item management before actually marking them. |

, where X is the number of the marked products.

, where X is the number of the marked products.