|

We recommend using the new reports described in this chapter to work with cash register data. These original reports are not modified or developed any further. |

Sale reports

Get the details of a specific sale set simply by clicking on the selected report on the image below:

|

If you have Dotypos EASY, you can browse through all reports, although exporting to Excel and .CSV is only available for the VAT control report and Receipts. |

Types of sale reports

Top employees

Based on the selected period, it displays the list of employees and the amount of their sales, sold items and issued cash register documents.

Top customers

Based on the selected period, it generates a list of customers with the amount of sales to the customer, sold items and issued cash register documents.

Sales by employees

Generates a list of receipts issued by employees either by a selected time period or by a specific customer. The list is divided by payment methods and can be also arranged by employees. This report can be used as an input for determining tips.

Customer sales

Generates a list of receipts drawn to this customer by either the selected time period or specific customer.

Sales by sellers

Generates a list of receipts drawn to this seller by either the selected time period or specific independent seller. In the report, you will also find a column with each vendor's IN if it is specified in the separate seller settings.

Canceled orders

The report consists of a list of canceled receipts by either the selected time period or cash register. It displays the name of the cash register that drew the document, the cancellation date, amount documented, currency, number of individual items in the order and their quantities and the name of the employee that drew the document.

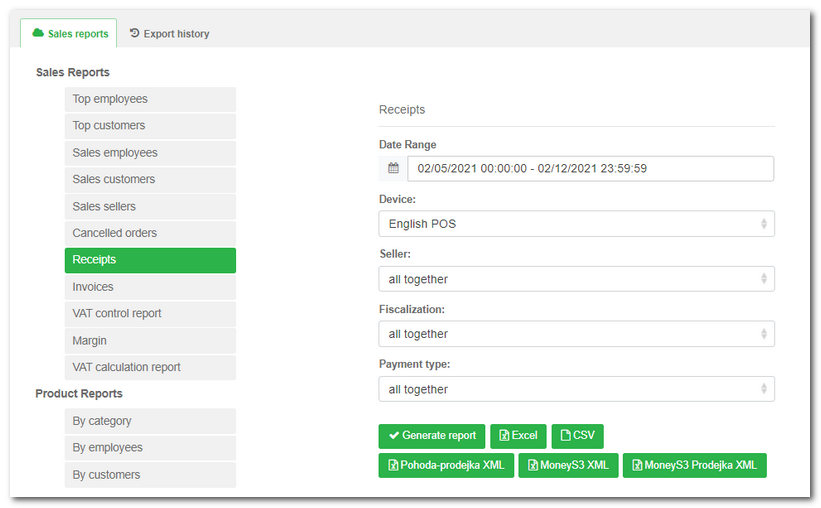

Receipts

Generates an overview of drawn receipts by either the selected time period or cash register. This report can be saved into an .xml file for the accounting programs Pohoda or MoneyS3. To export the report into these formats, use the button Pohoda-XML sale document or MoneyS3 XML. The exported file will contain Sale documents with items.

|

For a successful import into MoneyS3 the products in the file exported from Dotypos must have at least one of the pairing (key) values filled out EAN, PLU or ExternalId (which is imported into MoneyS3 as a catalogue number) and subsequently the products must be stocked into a MoneyS3 warehouse. The information on importing sale documents into MoneyS3 can be found in this accounting program documentation. |

|

The report Receipts can be easily limited to a specific shift, so only receipts for the selected shift (from opening the cash register till closing it) will be displayed. The instructions for this can be found in the chapter describing the sales report Shifts. |

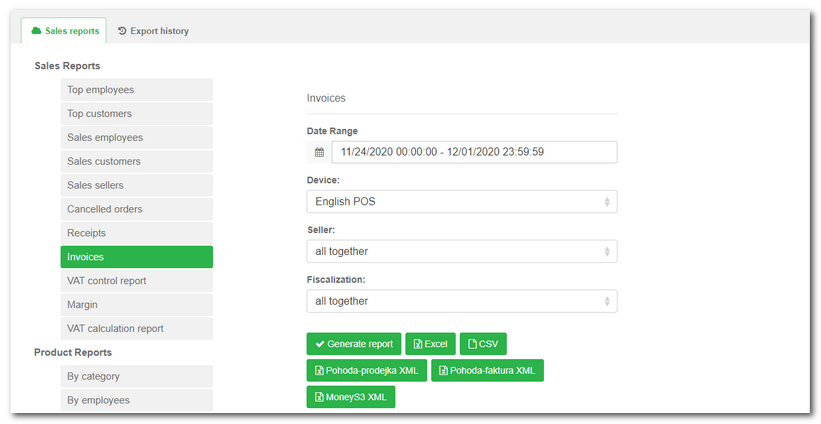

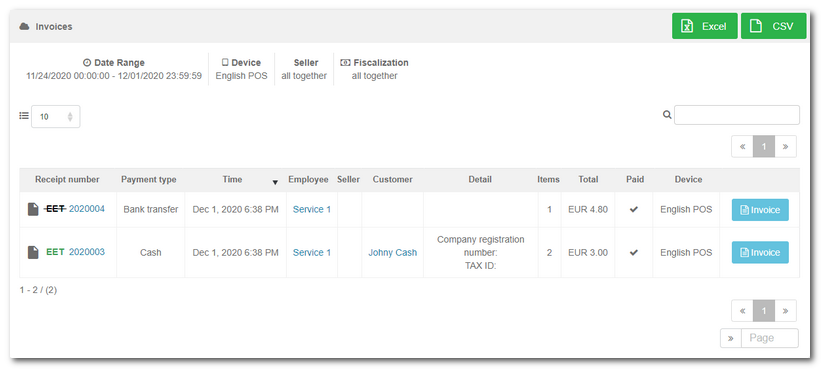

Invoices

Generates an overview of issued invoices either by the selected time period or cash register. This report can be saved into an .xml file for the accounting programs Pohoda or MoneyS3. To export the report into these formats, use the button Pohoda XML or MoneyS3 XML. The generated report is similar to receipts, however it contains different columns. Click the button Invoice for every record you will display the appropriate receipt.

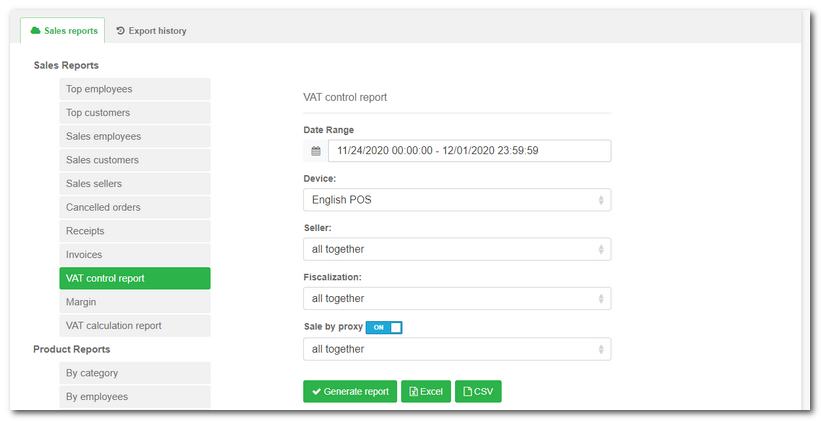

VAT control report

Generates a sales overview covering all cash documents higher than CZK 10,000 by either the selected time period or cash register. You can filter the results according to selling by proxy (only relevant when the button is switched to ON). In this case either all documents issued by the proxy are displayed or only the specific proxy selected, and eventually just the sales themselves.

Margin

Displays a list of items with the calculated purchase price, sales price, margin and profit by the selected warehouse. The purchase price is the sum of all ingredients reflecting the amount of ingredients to be deducted at the time of the sale. If the item is directly recorded and stocked in the warehouse, then it is the purchase price of the selling item itself.

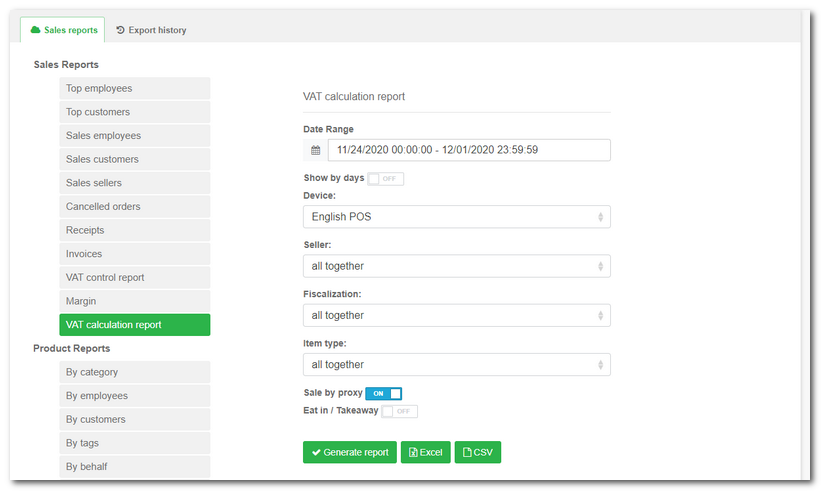

VAT calculation report

Itemizes sales and the number of documents drawn according to the payment method by either the selected time period or cash register. You can filter the results according to selling by proxy (only relevant when the button is switched to ON). In this case either all documents issued by the proxy are displayed or only the specific proxy selected, and eventually just the sales themselves.

If you want to perform a VAT breakdown for each day of the selected period separately, turn the switch Breakdown by days to the position ON.

|

For the requirements of your accountants, simply create an account in Dotypos Cloud and restrict user privileges only to Reports. This way you can limit the users to Reports and their exporting. They will not be able to change anything else in Dotypos Cloud. |