Read this chapter if you want to understand correctly how Dotypos works and handles data. You will find here important terms and operations and also how they relate to the sales overview and warehouse items.

Opening and closing the cash register

|

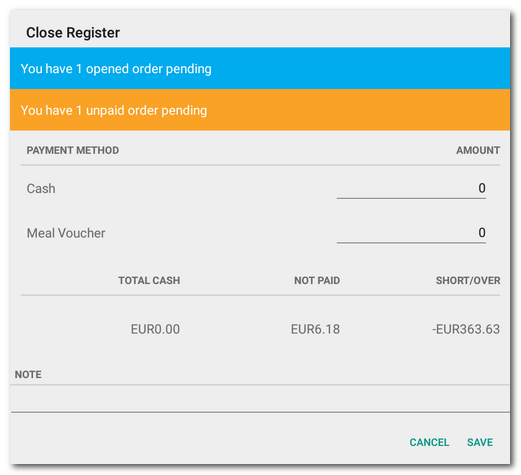

How Dotypos calculates the purchase price?  Note: Dotypos does not use FIFO to calculate the purchase price. |

Open orders

“Open order” is an unsettled order you may be working with where you can add more items anytime. How to create and work with open orders is described in this chapter. When you create an open order, the value of this order does not increase sales nor deduct items in stock from the charged items. The value of open orders can be displayed in the sales overview. If all orders are not closed (settled) at the time of closing the cash register, you will be notified about it.

The sales overview lets you find the following items in open orders (these items are only informative):

Open orders (shift) |

Total number of currently open orders from preceding shifts or days |

Open orders (total) |

Total value of currently open orders from this and preceding shifts or days |

Settling orders

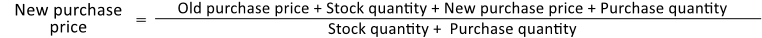

Information about how to issue and settle orders can be found here. As soon as you click on the button Issue order on the main screen you will see the Payment dialog. At the moment when goods are charged they are immediately stocked out, the open order is recorded and a new cash document is created.

In the Payment dialog you can select the payment method; in the initial settings there are available Cash and Credit card. After tapping on the selected payment method, the order will be paid.

The value of the settled order will increase total sales and cash received, which you have physically obtained and will be required when closing the cash register. When payment with a card is chosen, total sales will increase by the value of the settled order. In the sales overview, you can find these transaction in Cashless transactions (Credit card). Cash received will not be affected and debit/credit card payments will not increase cash in the register.

The next option in the Payment dialog is Not Paid. This means the order will remain recorded in sales and goods will be stocked out, but the customer has not yet paid the drawn order (e.g. the customer had no cash on hand and will return later). Such an order does not increase received cash either. Unpaid orders can be filtered in the History and paid subsequently. If the cash register is closed with orders open, you will be alerted that “Cash register has x open orders recorded”. This notice appears every time the cash register is closed until the order is settled, although only up to 3 months. Any older open orders are ignored.

Order cancellation

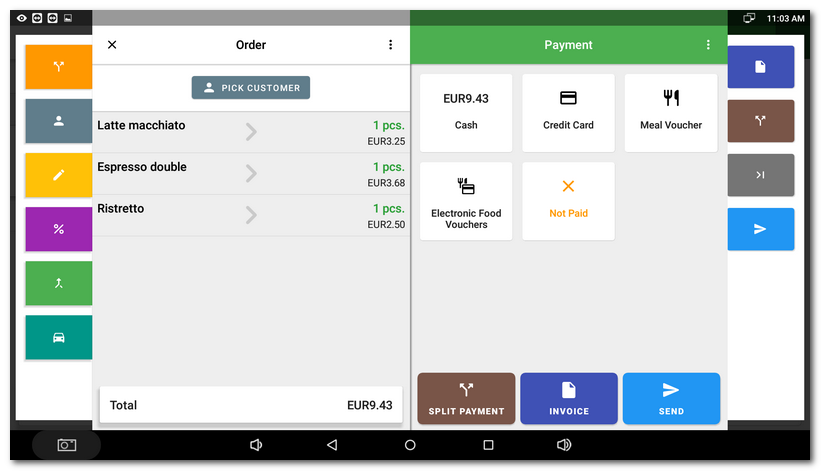

The order can be canceled in History by clicking on the selected order and choosing the option Cancel this order  via the button

via the button  . When canceling an order there are two possibilities: cancellation without reversing the stock in of sold items or canceling stock in, with the sold items and ingredients returning back to the warehouse.

. When canceling an order there are two possibilities: cancellation without reversing the stock in of sold items or canceling stock in, with the sold items and ingredients returning back to the warehouse.

The cancellation of an already closed order decreases the actual cash balance in the register by the value of the canceled order. The cancellation of an unpaid order does not change the amount of cash in the register, it will be recorded in sales the same way as when a closed order is cancelled.

Cash in / out

The button Cash in/out is for cash entering and leaving the register during the current shift. Cash in/out either increases or decreases the final cash in hand balance when the Z-report is run. In the sales overview you can find the value of cash entering in Cash in; cash expended is in Cash out.

Opening and closing the cash register

Before any product can be sold you have to open the cash register. When the cash register is opened, the initial cash balance - the amount of money actually available in the cash register - is entered. The shift begins with the opening of the cash register. Sales accumulate the amount recorded in the cash register. At the end of the shift, the cash register must be closed.

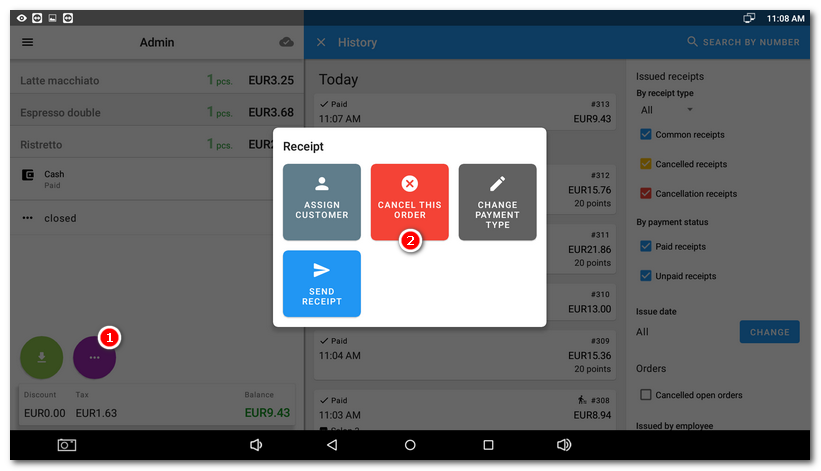

After the cash register is closed, the final cash balance is entered in the register. Ideally, the final cash balance should equal the sum of the initial cash balance, cash received from goods sold, cash deposits, and where appropriate any reductions caused by cancellations and cash out when cash leaves the register. Based on the difference between the amount calculated by Dotypos and the amount entered as the final cash balance, the system calculates any shortages or excesses after the cash register is closed. Depending on the set up in the user privileges, the cash register can display this amount even before the cash register is closed. When closing the cash register, you will also be provided information about unsettled and open orders; see the preceding information.

Final value

How does Dotypos calculate the final value? VAT is added to the product price at the set rate and results are rounded. The result is then multiplied by the amount sold and rounded again:

Price without VAT + VAT rate ≅ Price including VAT x quantity sold ≅ Final value

|

To understand the process of how Dotypos counts, we recommend becoming familiar with individual items in the Z-report. |

VAT

Dotypos does not calculate VAT from the total rounded sum of sales, but from the VAT of individual order items. Then, for individual items the calculated price without VAT is rounded to 2 decimal places, because in the Czech Republic the VAT sum on receipts is reported with 2 decimal places.

|

Remember that the price without VAT + the VAT value = the price including VAT and vice versa. |

Just an example of the VAT calculation

The price per one piece of product that is subject to the basic tax rate is CZK 36.90 without VAT.

•Tax calculation: 36.90 × 21% = 7.749

•The result is rounded to two decimal places: CZK 7.75

•Total price: 36.90 + 7.75 = CZK 44.65

•After rounding to whole CZK when paying in cash: CZK 45

The rounding amount of CZK 0.35, which appears as a new receipt item, is not included into the tax base. In the VAT breakdown, the rounding is specified separately.

Examples of detailed calculation

•The order contains 3 items with a unit price of CZK 35 with VAT 15%.

•The calculation is based on the price including VAT:

•3 pcs x 35 = CZK 105 = total price including VAT

•VAT = 105 – 91.30 = CZK 13.70.

With an order of 25 items in total (25 x 3 pcs of item per CZK 35), the calculation would be as follows:

•105 x 25 = CZK 2,625 including VAT

•91.30 x 25 = CZK 2,282.50 without VAT

•VAT = CZK 342.50

When we have 15 receipts with these 25 × 3 items per CZK 35. The individual sums must be counted up:

•with VAT = 2.625 x 15 = CZK 39,375

•without VAT = 2,282.5 x 15 = CZK 34,237.5

•VAT = 342.5 x 15 = CZK 5,137.5

|

It is a mistake to assume the VAT calculation from the total value including VAT in the amount of CZK 39,375 (from the example above), which is displayed in the sales overview at Dotypos Cloud. The result of this calculation would be 39,375 / 1.15 = CZK 34,239.13 without VAT. Subsequently the calculated VAT would be |